You only need to file a tax return if your income is over a certain amount or if you qualify for certain credits and refunds, or if you have certain information that needs to be reported. Here’s how you know:

Your income

Whether you need to file based on income depends upon your filing status, what your gross income is, and how much tax was withheld from your income. It’s rather complicated and rather than list all the options here, it’s easier to go to the IRS web site to work through a series of questions to get the answer. You can file, even if you don’t have to, but be aware that you may be using an appointment that someone else, who needs to file, won’t be able to have.

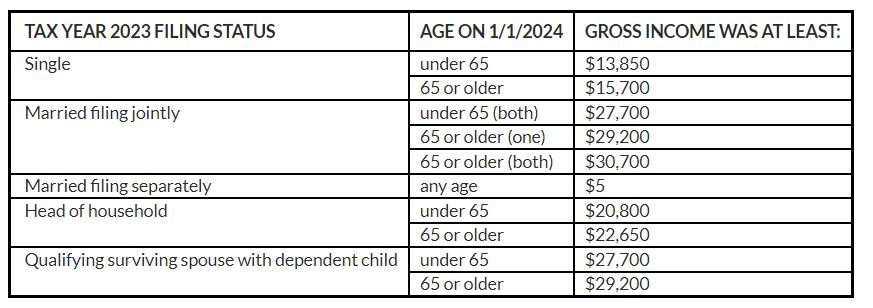

For most people who cannot be claimed as a dependent this table will suffice. But, if married filing separately and lived with spouse or if half of social security benefits plus tax-exempt interest plus gross income is greater than $25,000 ($32,000 if married filing jointly), or if you are a dependent and have income, then use the IRS web site instead.

Do not include social security benefits in gross income for this table.

You must file if :

(blue means you will need to go to a professional tax preparer)

- You owe any special taxes, including any of the following.

- Alternative minimum tax

- Additional tax on a qualified plan, including an individual retirement arrangement (IRA), or other tax-favored account. But if you are filing a return only because you owe this tax, you can file Form 5329 by itself.

- Household employment taxes. But if you are filing a return only because you owe this tax, you can file Schedule H by itself.

- Social security and Medicare tax on tips you did not report to your employer or on wages you received from an employer who did not withhold these taxes.

- Recapture of first-time homebuyer credit.

- Write-in taxes, including uncollected social security and Medicare or RRTA tax on tips you reported to your employer or on group-term life insurance and additional taxes on health savings accounts.

- Recapture taxes.

- You (or your spouse, if filing jointly) received HSA, Archer MSA or Medicare Advantage MSA distributions.

- You had net earnings from self-employment of at least $400.

- You had wages of $108.28 or more from a church or qualified church-controlled organization that is exempt from employer social security and Medicare taxes.

- Advance payments of the premium tax credit were made for you, your spouse, or a dependent who enrolled in coverage through the Marketplace.

- Advance payments of the health coverage tax credit were made for you, your spouse, or a dependent.

- You have a net tax liability that you deferred by making an election under section 965(i).

You should file if:

- You had income tax withheld from your pay, pension, social security or other income.

- You made estimated tax payments for the year or had any of your overpayment for last year’s estimated tax applied to this year’s taxes.

- You qualify for the earned income credit.

- You qualify for the refundable child tax credit or the additional child tax credit.

- You qualify for a refundable credit for child and dependent care expenses.

- You qualify for a refundable American Opportunity Credit.

- You qualify for the Premium Tax Credit.

- You qualify for a Recovery Rebate Credit, but either didn’t receive an Econoic Impact payment (EIP) or received less than the amount you are eligible for.

- You receive a 1099-B and the gross proceeds plus other income exceeds the filing limits.

- You receive Form 1099-S, Proceeds From Real Estate Transactions.

- You are required to file a state return.

- You want to file a $0 AGI return (such as to prevent tax identity theft, to claim a state credit, or for other assistance).

- You qualify for the refundable credit for prior year minimum tax.

- You qualify for the federal tax on fuels.

- You qualify for the refundable sick and family leave credits for certain self-employed individuals.